EU New Green Deal and China´s and Myanmar´s critical raw materials and rare earth

A conflict of conscience rages in Brussels over the critical raw materials from which the future is made. Among other things it is about: Rare earths for smartphones and permanent magnets, such as those used by wind turbines, electric cars and e-bikes. Gallium and indium for light emitting diodes.Silicon metal for semiconductors. Platinum group metals for hydrogen fuel cells. Lithium for e-car batteries. The problem: The EU is dependent on imports for all of these substances. And most of them come from countries whose governments should not shy away from using the associated blackmail potential – especially China. Therefore, there is talk of “critical raw materials” – scarce goods with a high supply risk.

The CDU MEP Hildegard Bentele warns: „We cannot rely on the Chinese continuing to sell us their rare earths in the quantities we need for many years to come.“ One percent of the raw materials for wind turbines are obtained and less than one percent of the lithium batteries and fuel cells are produced in the EU. “ Bentele is the European Parliament’s rapporteur responsible for the controversial issue. Her deliberations on this now passed through Parliament. This includes the recommendation to continue to permit mining projects in nature reserves to a limited extent and subject to conditions. Bentele believes: “We also have to explore our own deposits and invest in sustainable mining. Some of the deposits are also located in nature reserves. We have to resolve this conflict with high standards and requirements and the best available technologies. „

This generates green criticism: EU environmental protection „ad absurdum“ Bentele’s direct opponent, „shadow rapporteur“ Henrike Hahn EP of the Green Party/ Die Grünen, accuses the CDU colleague of having cleverly ensured at the last minute that ecological damage could now be generated in the name of the European Union’s „Green Deal“. „Extraction of raw materials in nature reserves takes EU environmental protection ad absurdum within the framework of the Green Deal,“ the Green MP is angry. Originally, the controversial motion for a resolution for Parliament said that “mining should be prevented in nature reserves”. Hahn locates Ursula von der Leyen’s EU Commission on Bentele’s side; In fact, EU Internal Market Commissioner Thierry Breton and Commission Vice President Maros Sefcovic have also spoken out in favor of domestic promotion of strategic raw materials. According to its own statements, the Commission sees “considerable potential” for this. Especially with battery raw materials such as lithium, nickel, cobalt, graphite and mangnesium, there are „interesting opportunities“ within the EU borders

So is the EU about to have some kind of modern gold rush? The European Raw Materials Alliance (ERMA), an alliance of companies, research institutions, government agencies and associations created on the initiative of the EU, has development projects including mining (in Nordic countries) with an investment volume of 1.7 billion euros across Europe on a list of desires. ERMA lures with the fact that this means that at least 20 percent of the European demand for rare earths that will arise by 2030 can be met for permanent magnets. In fact, the EU has the potential to become a “world leader in sustainable production of rare earth materials”. In Sweden, residents, environmentalists, business and government have already fought a long and tough battle for the future of the Nora Kärr region and the localized rare earths deposits there. In the event of development, their opponents fear negative effects on the nearby lake Vättern, the second largest in the country.

However, Liberal belief in technical progressseems to prevail. The Environment Committee of the European Parliament sees mining in general as „associated with various dangers of pollution of surface and groundwater“. However, the greatest challenges in extracting critical raw materials only arise after mining. In many cases they have to be separated physically and chemically from base components; processing them requires a considerable amount of energy. The Federal Institute for Geosciences and Raw Materials points to „radioactive residues containing heavy metals“, „sulfur-containing exhaust gases“ and even „high direct greenhouse gas emissions“ in the processing of rare earths. The Greens MP Hahn insists that an “undifferentiated call for more mining for all critical raw materials regardless of losses” is wrong; an opportunity had been wasted to „spare unique natural areas from the feared increase in the extraction of critical raw materials“. The FDP MEP Andreas Glück contradicts: “Let’s assume that you have mapped a deep deposit of important critical raw materials, but rare, rightly protected species live on it – on the earth’s surface. If, thanks to innovative processes, it were now possible for you to dig the deposit sufficiently far away and deep underground without affecting the nature reserve above, is not the general reluctance of colleagues to the detriment of local resources and short distances to be reduced to absurdity? „

However, the Greens have doubts about demand forecasts Hahn also sees the EU’s import dependency as a problem and admits: “That is one thing that has to be faced in Europe.” However, the Greens suspects that “artificially high forecasts” for the future demand for critical raw materials are in circulation , based on an expert opinion commissioned by the Öko-Institut in Freiburg. This contrasts with estimates by the EU Commission. According to this, up to 18 times more lithium and five times more cobalt could be required for electric vehicle batteries and energy storage by 2030 than today; the demand for rare earths could increase tenfold by 2050. Recycling is not a quick solution despite treasures in the affluent garbage . Recycling is not a solution, not yet, although real treasures lie dormant in high-tech affluent garbage. UN experts estimate that the total value of secondary raw materials in waste electrical and electronic equipment was around 55 billion euros in 2016. However, less than 40 percent of old devices in the EU are currently being recycled. So-called “urban mining”, the recovery of useful substances from municipal waste, is still emerging, too slow for the EU’s lofty future plans.

The CDU politician Bentele expects: “It will take ten to 20 years to build up a secondary raw material market. Until then, however, there will be a significant increase in demand. The ecological and digital offensive of the EU means that the demand for critical raw materials is increasing. “ Former coal fields are to become modern treasure troves Bentele’s EPP Group is convinced: „Without easy access to critical raw materials there will be no Green Deal.“ The EU Commission wants to identify mining and processing projects for critical raw materials in the next four years. One of the hopes is that one could still find bonanzas for high-tech purposes in the legacies of the expiring coal mining industry – and thus jobs for people whose previous jobs are threatened by the “Green Deal” by EU Commission President Ursula von der Leyen.

But China still is important for the global and the EU´s raw material and rare earth supply. And Myanmar therefore is critical for China´s and the global rare earth supply. Chinese rare earth mining in North Burma and Naga land has already has become a hot topic in the CCP´s mouth piece Global Times:

“Myanmar rare earths heading toward China encounter shipment obstacles amid upheaval

Orderly increase in domestic mining, technology crucial for secure supplies: experts

Some Chinese rare-earth companies and their downstream firms are finding that their raw materials could not be shipped smoothly from Myanmar, a key supplier of medium and heavy rare earths for China, amid political upheaval in the Southeast Asian nation, although mining operations remain unaffected, several sources at those companies told the Global Times on Sunday.

Myanmar’s rare-earth exports to China have dwindled to some extent, which has led to soaring rare-earth oxide prices in the market, a manager of a rare-earth enterprise in Ganzhou, East China’s Jiangxi Province, told the Global Times on condition of anonymity.

He noted that the rare-earth mine in Myanmar from which the company gets its supplies has been operating as usual. But logistics issues have hindered exports since mid-March.

„When the political upheaval erupted in February, rare-earth exports to China remained unaffected, as most rare-earth mines are located in the northern part of the country where the situation had been stable, but things worsened in recent days,“ the manager said.

He said that Myanmar sits at the upstream of the global rare-earth industry chain, accounting for half of the global rare-earth ores. Its heavy rare-earth minerals are exported to China for extraction and processing, and then exported to the world.

Another manager of a private rare-earth magnet producer based in Ganzhou surnamed Zhang confirmed the existence of logistics barriers in speaking with the Global Times on Sunday.

„The biggest issue is that rare earths from Myanmar cannot be shipped to China, and it is not clear when this barrier will be removed, as it is highly dependent on Myanmar’s political situation,“ Zhang said, predicting that the world may suffer from rare-earth shortages for some time.

The general manager surnamed Chen at a Dongguan-based company that makes magnetic material from rare earths told the Global Times on Sunday that its raw material costs have surged at least 30-40 percent since beginning of the year.

With the COVID-19 pandemic already brought under control in China, downstream firms in the fields of consumer electronics and new-energy vehicles have been buying more rare earths, which have driven prices higher.

Chen also confirmed to the Global Times that one of the firm’s upstream suppliers of rare earths could not ship the metals from Myanmar at the moment.

Given the current situation, China’s rare-earth imports from Myanmar might plunge in March, said an industry insider who asked to remain anonymous.

In the January-February period, rare-earth oxide imports went up 24.6 percent year-on-year to 3,546 tons, customs data showed.

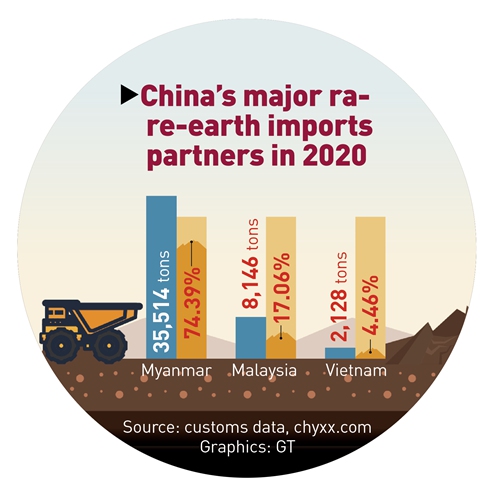

China’s rare-earth imports from Myanmar rose by 23 percent from 2019 to around 35,500 tons last year, accounting for 74.39 percent of total imports, followed by Malaysia with 17.06 percent and Vietnam with 4.46 percent, according to customs data.

China has been heavily dependent on medium and heavy rare earths from Myanmar in recent years, which account for more than 60 percent of China’s total ion-absorption rare-earth use, as the Chinese government has cracked down on illegal mining and strengthened measures in environmental protection.

Compared with light rare earths, heavy rare earths are less common and more valuable, and they are used in high-tech fields such as aerospace, military, national defense, and the synthesis of new materials.

A report by Soochow Securities pointed out that medium and heavy rare earths will potentially be affected the most during the unrest in Myanmar. If the unrest affects mines, which could lead to production declining or being halted altogether, or even export controls, it will have a greater impact on the supply of this category of rare earths.

The industry insider said that „China should diversify its import sources like from Vietnam, Laos and Cambodia, but we should also be clear that transferring the supply chain is not that easy to do in a short time, and there are a lot of uncertain and unstable factors surrounding new supplies from those potential sources.“

He underscored the significance of guaranteeing resource supply security.

Looking internally, China’s own reserves of heavy rare earths, mainly in southern China, can easily meet rising domestic demand.

„We should ramp up mining at a pace and in an orderly way under the condition that the activity meets environmental protection requirements,“ said the insider.

The Ministry of Industry and Information Technology and Ministry of Natural Resources hiked the first batch of quotas for rare-earth mining output this year, to be shared among six major producers, to 84,000 tons, a significant increase from the 66,000 tons in 2020.

Zhang Anwen, a vice secretary-general of the Chinese Society of Rare Earths, told the Global Times on Sunday that there are several approaches to deal with tightening heavy rare-earth supplies in China and high technologies turned out to be an effective way, by reducing the usage of dysprosium and terbium in making neodymium magnets, which are widely used in various products such as electric vehicles and hard disks.

„The technology has become more mature and is a direction that needs more efforts,“ said Zhang.

https://www.globaltimes.cn/page/202103/1218983.shtml

Therefore the Global Times cheerfully reports that the Chinses- Burmese rare earth trade is normalizing independent from the bloody civil war of the military junta against the democratic opposition and the minority groups.

“China, Myanmar resume rare-earth trade after border reopening, to ease prices shortly

Elevated prices expected to ease, but longer-term gains likely: analysts

By Li Xuanmin and Xie Jun

Published: Dec 02, 2021 07:43 PM

Myanmar resumed exporting rare earths to China after the reopening of China-Myanmar border gates in late November, sources told the Global Times, and analysts said that rare-earth prices are likely to ease in China as a result, although price rises are likely in the longer term because of China’s focus on carbon emission cuts.

A manager of a state-owned rare earth company based in Ganzhou, East China’s Jiangxi Province, who is surnamed Yang told the Global Times on Thursday that customs clearing for rare-earth minerals from Myanmar, which had been held up at border ports for months, resumed at the end of November.

„There are trucks carrying rare-earth minerals coming into Ganzhou every day,“ Yang said, while estimating that about 3,000-4,000 tons of rare-earth minerals had piled up at the border port.

According to thehindu.com, two China-Myanmar border crossings reopened for trade in late November after being closed for more than six months due to coronavirus restrictions.

One crossing is the Kyin San Kyawt border gate, around 11 kilometers from the northern Myanmar city of Muse, and the other is the Chinshwehaw border gate.

The timely resumption of the rare-earth trade could reflect the eagerness of the relevant industries in the two countries to resume doing business, as China is reliant on Myanmar for rare-earth supplies, experts said.

About half of China’s heavy rare earths, such as dysprosium and terbium, come from Myanmar, Wu Chenhui, an independent rare-earth industry analyst, told the Global Times on Thursday.

„Myanmar has rare-earth mines that are similar to those in China’s Ganzhou. It’s also a time when China is striving to adjust its rare-earth industries from large-scale dumping to refined processing, as China has grasped many technologies after years of extensive development,“ Wu said.

Experts said that the resumption of the rare-earth trade should lead to lower prices in China, at least for some months, after prices have grown since the beginning of this year. Wu said that the decline is hard to predict, but it might be within 10-20 percent.

Data on China’s bulk commodity information portal 100ppi.com showed that the price of praseodymium-neodymium alloy surged by about 20 percent in November, while the price of neodymium oxide was up by 16 percent.

However, analysts said that prices might head higher again after several months, since the fundamental upward trend has not ended.

An industry insider based in Ganzhou, who spoke on condition of anonymity, told the Global Times on Thursday that the rapid gain in upstream supply may lead to short-term price falls, but the long-term trend is up, due to labor shortages in the industry.

„Exports are estimated to be basically the same as before. But Chinese exporters may not be able to catch up with demand if foreign buyers purchase rare earths in large volumes,“ the insider said.

Wu said one important reason for the higher prices is that China’s demand for rare-earth ores and products is surging with the government’s focus on green development. Rare earths are widely used in products like batteries and electric motors to enhance the products‘ performance.

„Also, the whole industry is aware of rare earths‘ value restoration, after the government raised the requirements to protect rare-earth resources and stop low-price dumping,“ he said.

Wu noted that as Myanmar resumes its exports to China, China’s rare-earth processing and exports will increase accordingly, but the market impact will be limited, as there haven’t been any significant changes in the world’s rare-earth supply structure.